If history is a reliable guide, the recession of 2008 is now unavoidable.

The dismal jobs report released Friday showed overall employment to be lower than it was three months ago. Every time such a slump has occurred since the early 1970s, a recession has followed — or already been under way.

And if the good times have really ended, they were never that good to begin with. Most American households are still not earning as much annually as they did in 1999, once inflation is taken into account. Since the Census Bureau began keeping records in the 1960s, a prolonged expansion has never ended without household income having set a new record.

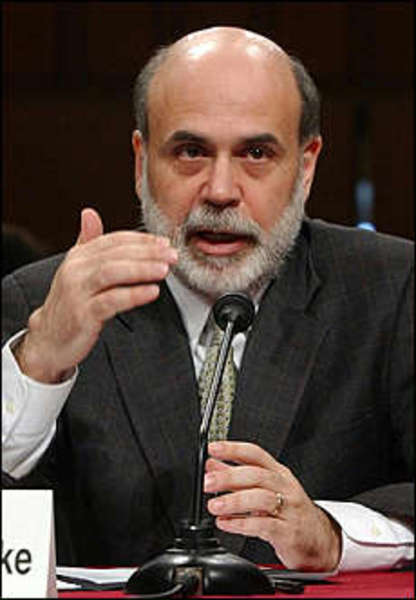

For months, policy makers and Wall Street economists have been predicting, and hoping, that the aggressive series of interest rate cuts by the Federal Reserve would keep the economy growing, despite the housing bust. But the possibility seemed to diminish almost by the hour on Friday.

Shortly after 8 a.m., the Fed announced yet another measure meant to unlock the struggling credit markets. At 8:30, the Labor Department released the unexpectedly poor jobs report. Almost immediately, the economists at JPMorgan Chase — who only last week had told clients they thought the economy was still growing — reversed course and said a recession appeared to have started earlier this year.

Stocks fell when the markets opened at 9:30, recovered and then fell again, with the Standard & Poor 500-stock index closing down 0.8 percent. Traders became even more confident, based on the price of futures contracts, that the Fed would cut its benchmark interest rate three-quarters of a point, to 2.25 percent, when policy makers meet on March 18.

“The question was always, ‘Would the economy hang on by its fingernails?’ ” said Ethan Harris, the chief United States economist at Lehman Brothers. Based on the employment report, Mr. Harris said, “there’s a very high probability that we’re in a recession now.”

Even the one apparent piece of good news in the employment report was a mirage. The unemployment rate fell to 4.8 percent, from 4.9 percent in January, but only because more people stopped looking for work and thus were not counted as unemployed by the government.

Over the last year, the number of officially unemployed has risen by 500,000, while the number of people outside the labor force — neither working nor looking for a job — has risen by 1.3 million.

Employment has risen by 100,000, but even that comes with a caveat: there are also 600,000 more people who are working part time because they could not find full-time work, according to the Labor Department.

“The decline in the unemployment rate,” said Joshua Shapiro, an economist at MFR, a research firm in New York, “should not be viewed as good news.”

Much of the economic stimulus put in place by the government will begin to take effect in the next few months, which does leave open the possibility that the country can still escape a recession. Policy makers have reacted quite quickly to this slowdown, relative to previous ones.

The Treasury Department will begin sending out rebate checks — of up to ,200 for couples, plus 0 per child — in May, as part of the stimulus package negotiated by President Bush and Democratic leaders in Congress. The Fed has already cut its benchmark short-term interest rate five times since September, and such reductions typically take six months or more to wash through the economy.

White House officials have predicted in recent weeks that the economy would avoid recession, but after the release of the jobs report, they offered a subtly different forecast. At the White House on Friday, Edward P. Lazear, the chairman of Mr. Bush’s Council of Economic Advisers, parried reporters’ questions about whether he now thought the economy would slip into a recession.

Instead, he said, “I’m still not saying that there is a recession.”

The administration does expect gro...